By Cyber Crime Bureau Correspondent | Hyderabad | November 4, 2025

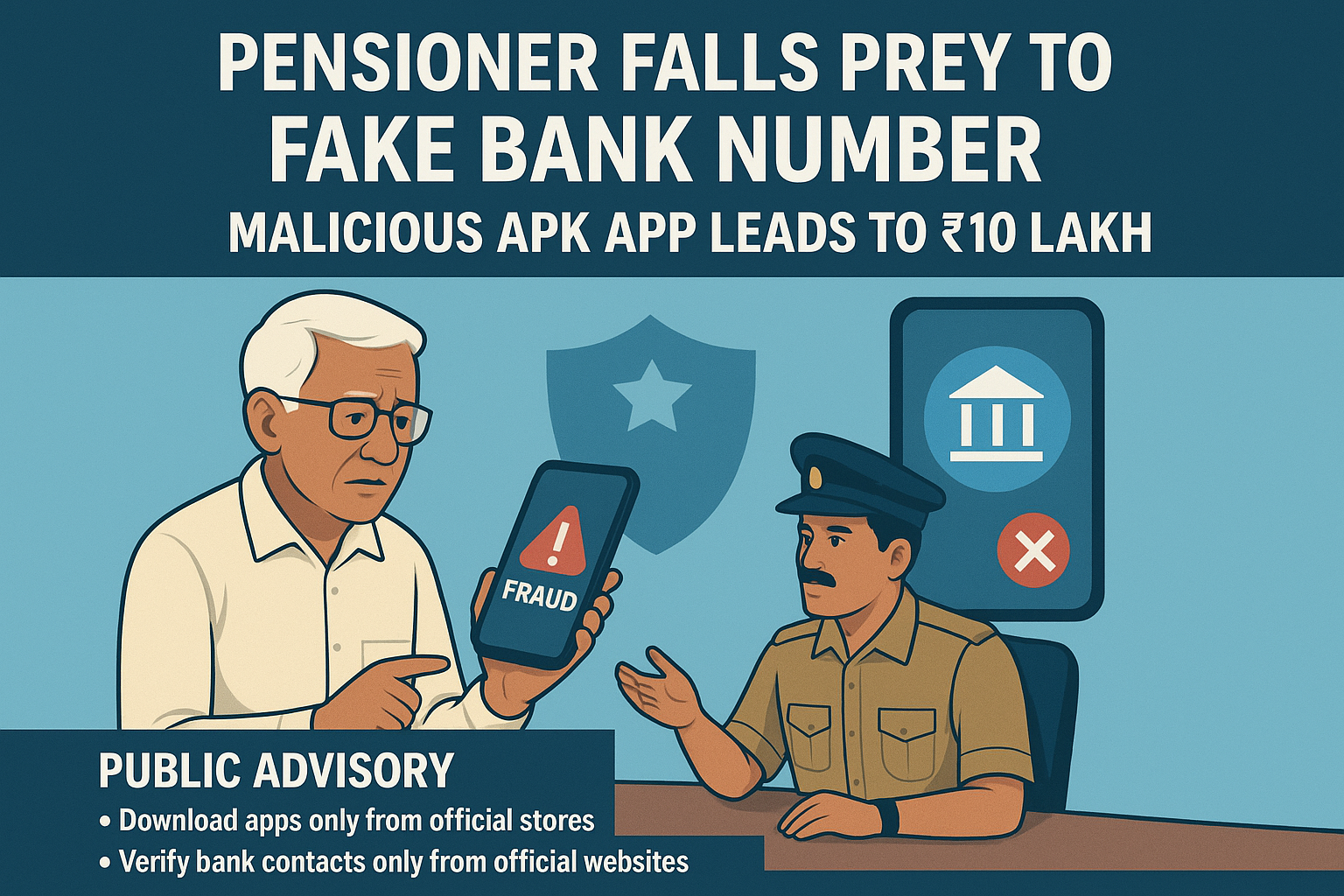

A 68 year old pensioner from Hyderabad lost ₹10 lakh after falling victim to a sophisticated cyber fraud involving a fake Punjab National Bank (PNB) contact number listed on Google. The incident, which occurred on November 4, 2025, highlights a growing trend in online scams exploiting fake helpline numbers and malicious Android APK applications.

According to police sources, the victim had searched for PNB’s customer care number on Google and unknowingly contacted a fraudulent number operated by cybercriminals. The callers, posing as bank officials, claimed they needed to “Verify” his account details and convinced him to install an APK file shared via WhatsApp.

Once installed, the malicious app granted the fraudsters remote access to the victim’s mobile phone allowing them to read SMS messages, intercept OTPs and gain full control over his online banking and digital payments. Within minutes multiple unauthorized transactions totaling ₹10 lakh were made from his account.

Swift Police Action Saves Half the Amount

The victim immediately approached the Hyderabad Cyber Crime Police where Constable N. Srikanth Naik swiftly assisted him in filing a complaint through the National Cyber Crime Reporting Portal (NCRP).

Investigators traced the fraudulent money trail through payment gateway Razorpay to Slice Small Finance Bank Ltd. Due to timely coordination between the cyber police and banking authorities, ₹5 lakh of the stolen amount was successfully blocked and recovered.

Officials commended Constable Naik for his quick response, which prevented further financial loss.

How the Scam Worked

Cyber experts explained that the APK (Android Package Kit) file installed on the victim’s phone was designed to bypass security systems. The app requested dangerous permissions including access to SMS, Storage and Screen sharing which allowed the scammers to:

- Read and intercept OTP messages.

- Gain login access to net banking and UPI accounts.

- Attempt to hijack the victim’s WhatsApp account for further frauds.

The same method has been used in several recent cases across India, Targeting pensioners, Senior citizens and Small business owners.

Public Advisory

Authorities have issued a cyber safety alert urging citizens to stay vigilant against such scams. Malicious APKs are often circulated under names such as:

- “RTO CHALLAN”

- “RTA CHALLAN 140.apk”

- “Customercare.apk”

- “Bank.apk”

Cyber Safety Guidelines

✅ Download apps only from official stores like Google Play or Apple App Store.

✅ Verify bank helpline numbers directly from official bank websites.

❌ Never install APK files received via WhatsApp, SMS or social media.

❌ Do not share OTPs, CVVs, or personal details with anyone.

❌ Avoid saving card details on e-commerce platforms, delete them after use.

Police Appeal

The Hyderabad Cyber Crime Police urge citizens to immediately report any suspicious online activity or fraudulent transactions via the National Cyber Crime Reporting Portal (www.cybercrime.gov.in) or the helpline 1930.

“Cybercriminals are using advanced social engineering and fake apps to exploit public trust. Public awareness and prompt reporting are the best defenses,” Officials said.